Deposits

Fixed Deposit Account

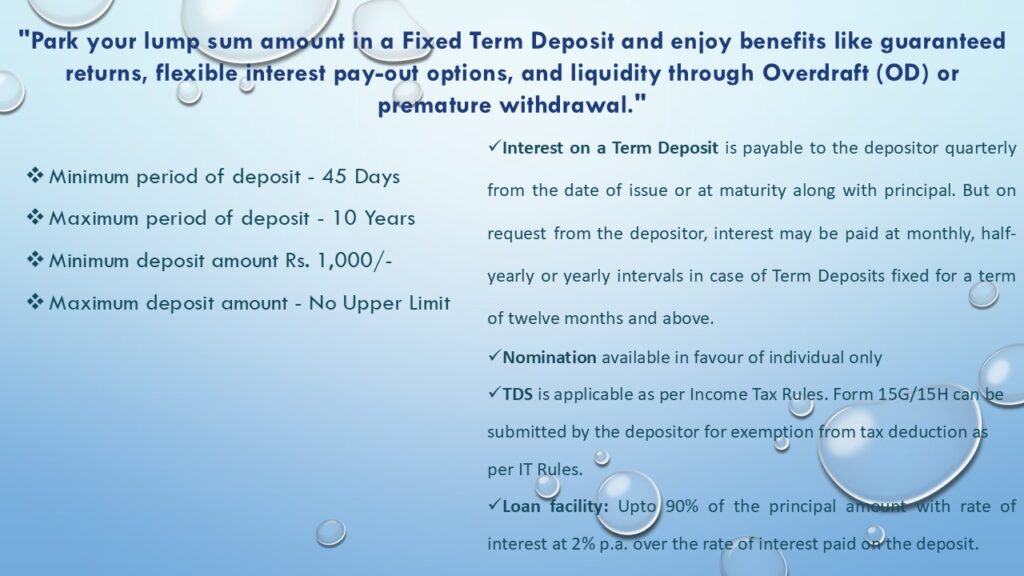

| Salient Features | A deposit for a fixed period carrying a fair interest. |

| Eligibility | Individuals – Single Two or more individuals severally or jointly, Payable to either or survivor, any one or survivor or jointly, Minor person through their guardians, Illiterates, Blind and handicapped people. Executors and Administrators. Liquidators and Receivers. Sole Proprietorship concerns and Partnership firms, Joint Hindu families firms, Corporate Companies. Trusts, Non-Corporate entities like Clubs, Associations, societies etc. Schools, Colleges. Government / Semi-Government bodies.. |

| Min Amt | Rs.1000. |

| Max Amt | No Maximum |

| Min Period | 46 Days |

| Max Period | 120 Months. |

| Other Requirements/Details |

|

- For Customers Knowledge

- Amendment to Section 194N w.e.f. 01st July 2020

- THE RESERVE BANK – INTEGRATED OMBUDSMAN SCHEME – 2021

- Please make your account KYC compliant

- Please link your Aadhar number to your account.

- Please update your passbook atleast once in 3 months

- Mention your PAN in the challen where remittance amount is Rs. 50000/- and above

- Use RTGS/NEFT facilities for your remittances

- Please keep updated your Address and Phone number with the bank for timely communications.

© SRI BANASHANKARI MAHILA CO-OPERATIVE BANK LTD