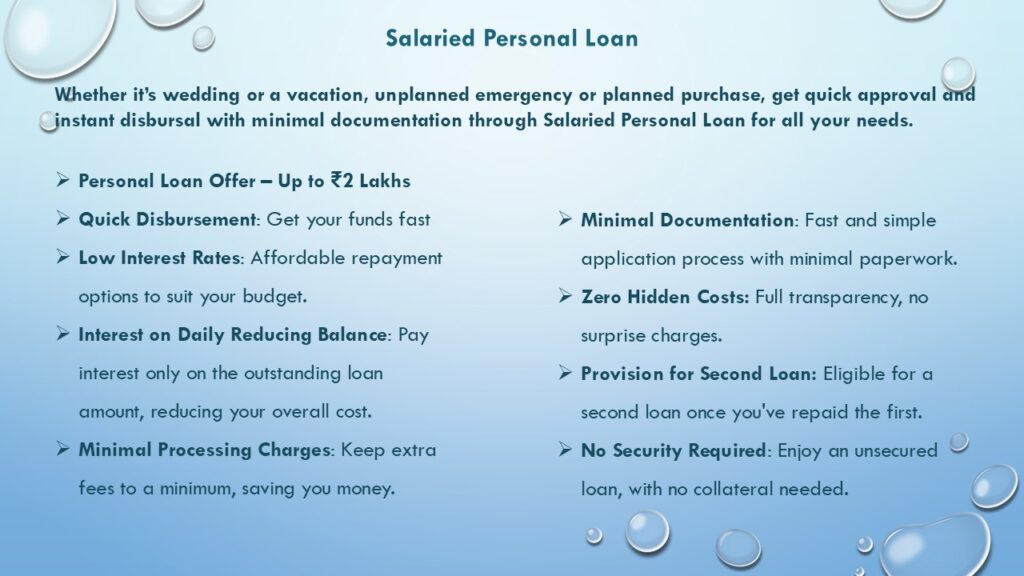

Salaried Personal loan

| Salient Features | A scheme mean for employees of the State Government Departments, Public Sector / Reputed Private sector/ Companies/ Co-operative Institutions/non salaried persons. small Business person/self employed persons. |

| Eligibility |

|

| Purpose of the Loan | Domestic/ Business/ Repayment of private debts. |

| Quantum of Loan | Max 2,00,000/- |

| Processing fee | * 1.10% on Loan amount with a minimum of Rs.250/- (Non refundable) |

| Interest Rates | As prescribed by the Board. |

| Tenure | Not exceeding 36 months. |

| Repayment Mode | In equal monthly installments with monthly interest or in equated monthly installments (though salary deduction in the case salaried persons) |

| Security | Personal security |

| Surety or guarantee |

|

| Documents to be submitted for processing the application |

|

| Release of the loan | Execution of prescribed document by the borrower and the surety. |

- For Customers Knowledge

- Amendment to Section 194N w.e.f. 01st July 2020

- THE RESERVE BANK – INTEGRATED OMBUDSMAN SCHEME – 2021

- Please make your account KYC compliant

- Please link your Aadhar number to your account.

- Please update your passbook atleast once in 3 months

- Mention your PAN in the challen where remittance amount is Rs. 50000/- and above

- Use RTGS/NEFT facilities for your remittances

- Please keep updated your Address and Phone number with the bank for timely communications.

© SRI BANASHANKARI MAHILA CO-OPERATIVE BANK LTD